Case Studies

Real strategies. Real returns.

RMR Partners has a unique approach to investing that draws out value from places where it might not be apparent. We identify under-appreciated assets in trending markets. Maximizing growth in ways that don’t appear in a spreadsheet. Our investments at RMR have created huge value for shareholders and employees.

Walnut Grove RV Resort

- Tiffin, Ohio | Status: Exited

- Asset Type: Campground & RV Park

Summary:

Acquired in 2021, Walnut Grove RV Resort is a 283-site campground along the Sandusky River about an hour from Lake Erie and well-situated between the metro and suburban areas of Cleveland and Columbus. With a post-Covid boom in the outdoor hospitality space, we identified a market growth opportunity by upgrading the campground to meet the new demand of campers in Northern Ohio.

Morgantown Park Portfolio

- Morgantown, West Virginia | Status: Exited

- Asset Type: Mobile Home Park & Apartments

Summary:

Acquired St Clair’s in 2021 and Woodland Terrace in 2022 for a combined 296 unit mobile home and apartment portfolio located in the high end Van Voorhis section of Morgantown. With older homes, deferred maintenance, and significant vacancy throughout the combined properties, we saw an opportunity to capitalize with stronger management and newer homes as there was tremendous demand for housing in Morgantown.

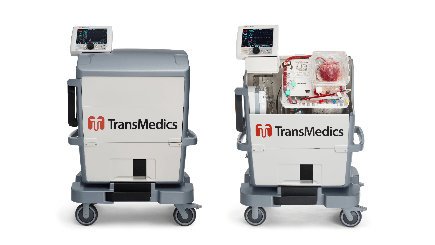

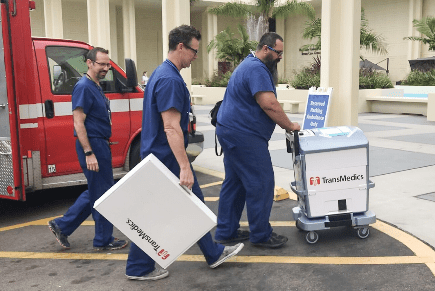

Transmedics

- Andover, Massachusetts | Status: Exited

- Asset Type: Healthcare Public Company

Summary:

Purchased stock in 2025, TransMedics is medical technology company that commercialized the Organ Care System (OCS), a portable platform designed to preserve, assess, and improve donor organs for transplantation. Its technology took the market by storm, increasing the number of usable donor hearts, lungs, and livers by many thousands annually.

What Makes RMR Different

Others

- Hands-off syndicated approach.

- One-size fits all investment and asset class.

- Using conventional real estate methods for modern business problems.

RMR

- We are heavily involved in all operational decisions and cut the largest investment check in our deals.

- Hand tailored opportunities that are difficult to source .

- Our varied business and real estate experience make us out of the box thinkers.