Our Process for Profitability

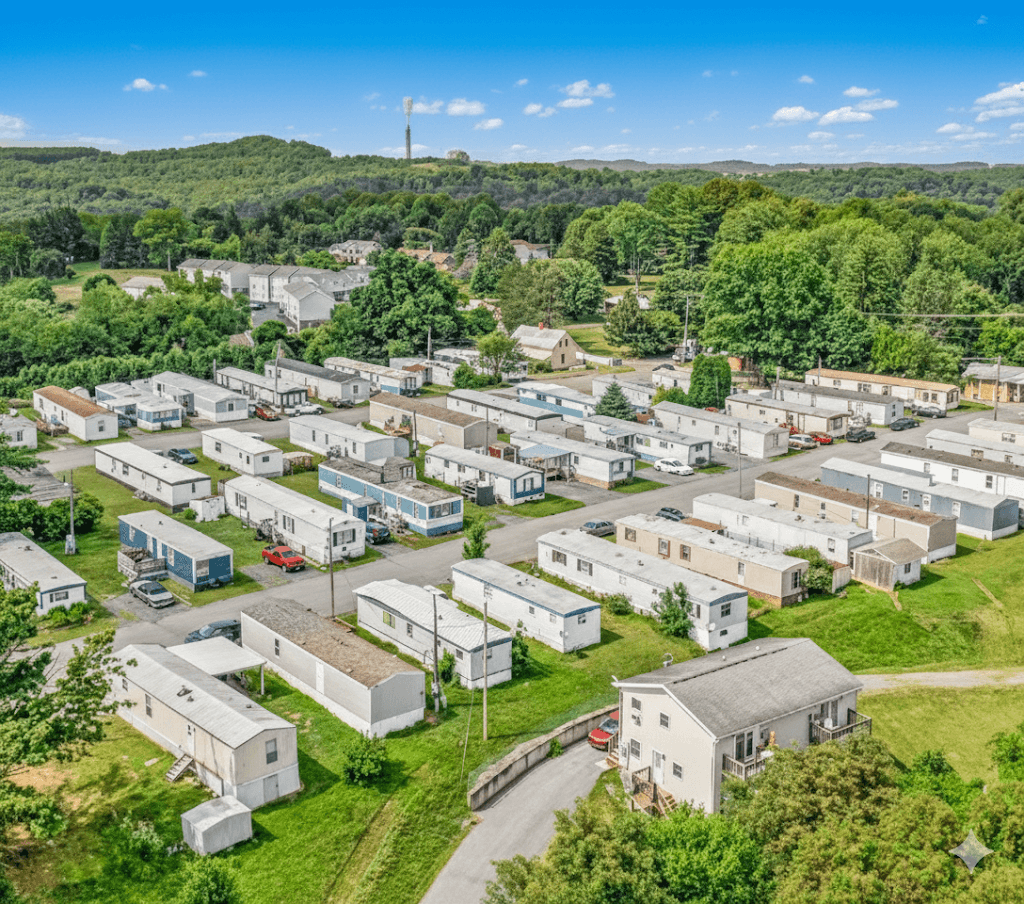

Scaling our Morgantown properties into an institutional portfolio.

Identifying Income Opportunities

St. Clair’s was charging below market apartment and lot rents because of a lack of focused management resulting in a deterioration of quality over the years. Under our new ownership, what was quickly apparent to us was our current tenant base was open to paying market rates if we could solve their various housing problems. We keyed in on major community issues and got to work putting in $475,000 of capital improvements including new roofs on the apartment buildings, major electric infrastructure upgrades, new water and sewer lines, and painting every single mobile home to each tenant’s desired color. As an added bonus, our manager Chris Farris suggested we refresh everyone’s individual driveways with brand new gravel pads. These improvements revived the community to its former glory.

Result Delivered:

With a motivated management team, improved aesthetics, and satisfied tenant base, we were able to increase lot rents by 20% from $375 to $450.

Home Revitalization

In order to appeal to an upgraded demographic, we wanted to bring in new homes thus driving occupancy and further enhancing the park’s appearance. We performed a major redesign of the home inventory. RMR spent $650,000 on 20 home purchases significantly raising occupancy and tenant quality. As we infilled the park, the demand for home sales and rental units was strong, and we were leasing with a waitlist.

Result Delivered:

Our upgraded park drove significant growth and interest throughout Morgantown. This resulted in an occupancy increase from 70% to over 90%.

A Larger Fish

In 2022 we had an opportunity to acquire Woodland Terrace, one of Morgantown’s biggest mobile home parks totaling 173 units. The playbook was similar to St. Clair’s so we felt very confident in our purchase and ability to execute a turnaround.

Result Delivered:

Woodland Terrace ended up being a tremendous deal for RMR as it scaled our portfolio and added key members to our staff.

Value Realization & Sale

Over the course of two years, our Morgantown parks experienced a net operating income increase of over 30%. With experienced hands on management leading the charge, the properties were significantly improved and ready for their next chapter. The mobile home park buying market continued to stay hot, and RMR chose to step out of our position through the sale of the parks to a large private equity firm. In the summer of 2023 we inked a deal in Morgantown and moved onto our next venture, industrial properties.

Result Delivered:

Acquired in 2021/2022 for combined purchase price of 6,300,000; sold in 2023 for $10,750,000 creating $4,450,000 profits for RMR Partners in 2.5 years.