Our Process for Profitability

Turning TransMedics into a high conviction investment.

Identifying the Opportunity

When we first looked at TransMedics, the market was overlooking it. Despite operating in the healthcare field, a sector we like for its recession resistance, the stock was trading well below industry multiples. Organ transplants are not elective, and the need is constant regardless of the economic cycle. Yet Wall Street had not fully recognized the moat TransMedics was building.

Result Delivered:

Flagged a recession-proof business priced like a cyclical one.

Deep Competitive Research

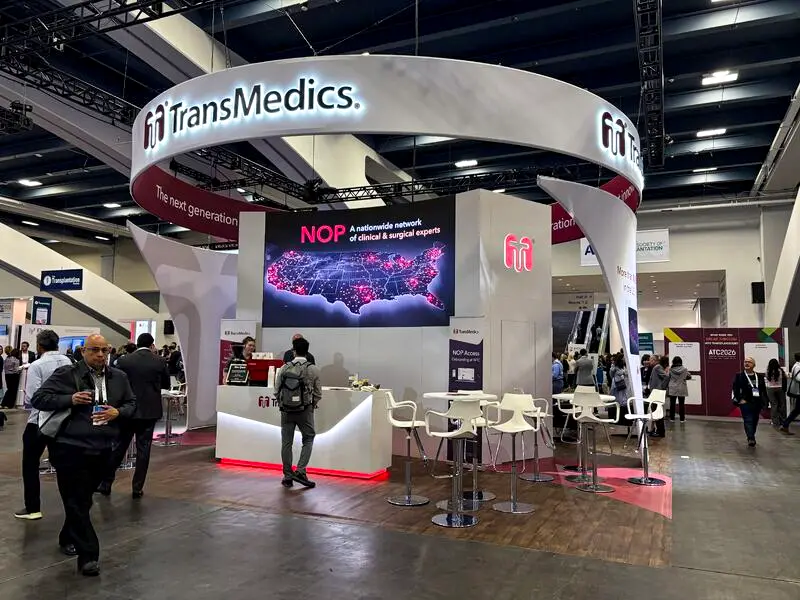

We don’t stop at 10-Ks. Our research meant combing through not only TransMedics’ calls but also competitor earnings, industry reports, and insights from the ISHLT (International Society for Heart and Lung Transplantation) conference. We were one of the very few investors in the room at ISHLT, which gave us firsthand perspective on industry adoption and competitor positioning.

Result Delivered:

Built conviction, years ahead of consensus, that TransMedics wasn’t just a medtech firm…it was transforming the transplant industry.

Uncovering the Hidden Advantage

Our analysis uncovered what others missed: the National OCS Program (NOP). By integrating logistics into the transplant process, TransMedics created an end-to-end solution that included organ procurement, preservation, transport, and coordination. We validated its early adoption in ways few others thought to — including tracking daily flight records to quantify growth before it ever showed up in financials.

Result Delivered:

Recognized the NOP as a game-changing moat, with leading indicators confirming its traction well before the market caught on.

Backing Superior Management

Numbers only tell half the story. What convinced us to act was the management team and their ability to thrive where most would retreat.

- COVID Response: During the COVID-19 moratorium, when lungs were the only approved organ, management adapted immediately and proved resilience under existential pressure.

- Building the NOP: They didn’t wait for someone else to solve logistics – they built the solution themselves, taking control of organ procurement through delivery.

- Aviation Strategy: When aviation partners failed to meet the standard, TransMedics brought aviation in-house. To outsiders it looked messy; to us it showed their understanding that in this industry, time isn’t money it’s life. That willingness to take on operational complexity created a moat no competitor could easily replicate.

It’s no surprise that for the most challenging transplant cases, TransMedics has become the first call. They don’t just provide equipment …they deliver certainty in an industry where certainty is everything.

Result Delivered:

Identified management as the true differentiator. Their vision, urgency, and refusal to accept industry limits cemented our conviction to take a substantial position.

Value Realization

Our thesis played out. The market began to recognize what we saw: TransMedics is not just selling devices, it is redefining organ transplantation. By tracking unique signals like aviation records, showing up where others didn’t (ISHLT), and trusting management’s ability to execute, we built conviction early. By backing that conviction with meaningful capital, we generated returns far in excess of market benchmarks.

Result Delivered:

Acquired 55,000 shares in 2025 for $70 per share; sold in 2025 for $125 per share creating $3,025,000 profit for RMR Partners in 9 months. A high-conviction bet that compounded into one of RMR’s strongest investment outcomes.